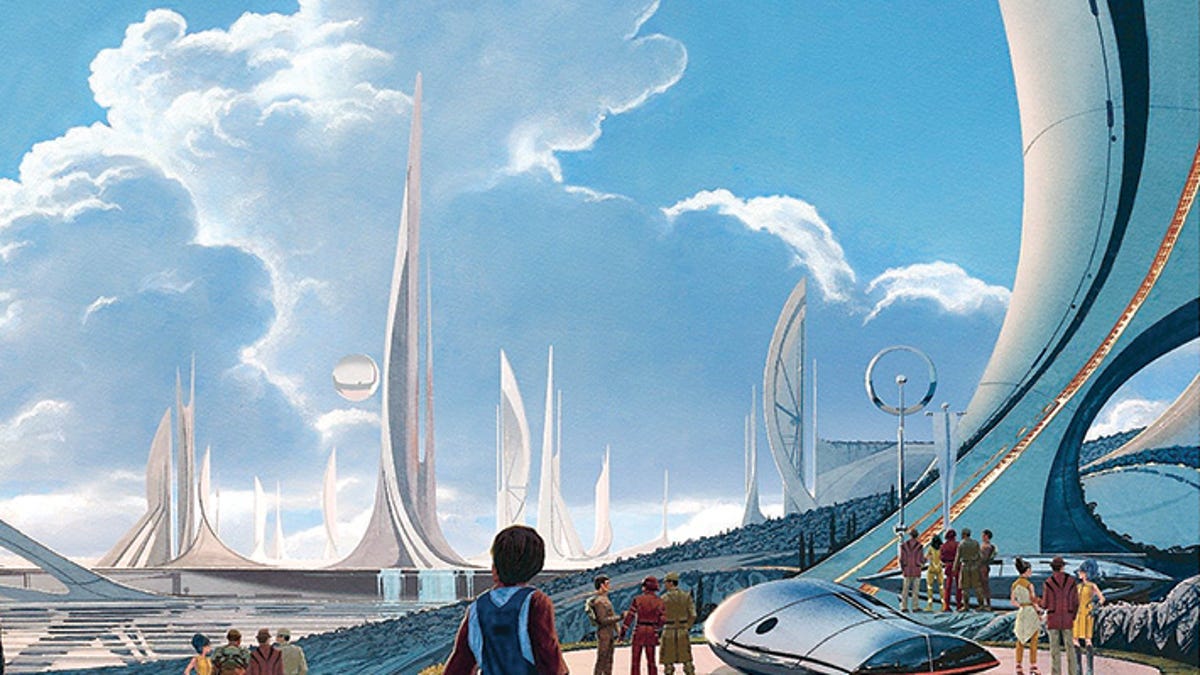

Disney's Tomorrowland by the late Syd Mead, advisor and friend

In a 2011 Wall Street Journal op-ed, Marc Andreessen, the cofounder of Netscape and A16z, famously penned the tagline of the decade to be repeated ad nauseam around the world by VCs henceforth:

Software is eating the world

Indeed at the time it was perhaps a radical statement, as many of the now house-hold names like Amazon and Netflix were just blasting off with the digitization of things - products, experiences, and services. The decades of investment and risks taken since the 1950s that birthed the US semiconductor industry, the phone, the internet, the personal computer, the laptop, and then the smartphone had laid the foundation for a new paradigm of human computer interaction where with relatively little effort (compared to building a physical device) and some lines of code, one could create a dizzying range of new apps, services, and of course ads.

The multiples sought after by VCs that once required “risky bets” could now be realized though much safer endeavors in software based companies. It was cool to move fast and break things. SaaS was HOT.

We have jumped the shark

“We wanted flying cars. Instead we got 140 characters.” - Peter Thiel, 2013

I actually love Twitter and think it has contributed a net positive outcome to the state of our society. However I couldn’t agree more with the underlying sentiment.

Though I’m a tech optimist, in the last few years I’ve become increasingly disenchanted by the state of innovation chosen and backed by the venture community. We as consumers are only receiving incremental (and only sometimes) benefit in the “ubers for this or that”, in the “we can serve ads in this super new way” companies, or in the “we reduce 10 minutes to buy this thing you don’t need so you don’t have to leave your house and interact with a human” companies.

This was inevitable. All stories need an ending. Phones have been maxed out in size and feature set for some time now and even going backwards- a lot of my friends and I have iPhone Mini’s. My Macbook has an insane battery life and is only 1cm thick. The apps and experiences built on these platforms are no longer fulfilling. Were they ever? Has social media helped anyone attain self actualization or genuine human connection? 2 billion people on the planet feel lonely and each generation just gets lonelier. We’re desperately squeezing out the last drops of actual new ideas and functionality out of our devices.

It’s time for new paradigms.

But hardware is hard?

We’ve been approached by a few VCs and industry giants since we launched our product- a physical consumer device that is essentially hardware enabled SaaS. But it wasn’t always so easy. For years we endured the same infuriating one liner, “hardware is hard”, by investors burned by one or two bad hardware deals (Segway, Juicero, and Magic Leap left too painful of a scar; disregard the countless software companies that raised equal amounts of capital only to die in equally big fireballs). The trauma of these deals gone wrong left a severe emotional bias towards focusing on the downside vs the upside in companies attempting to build hardware.

As first time founders and “outsiders” (no Stanford nor ivy league degrees, no MBAs amongst the founders, no network in the valley), we were an impossibly crazy bet for 97.1% (real number) of the investors that we initially spoke with. In hindsight, it was understandable. We were and still are a moonshot in our attempt to create a new category of products we call “Connected Human”. There were probably 2-3 “impossible” obstacles that we had to overcome to be here now. With the same funding a SaaS or App startup might receive, we invented, manufactured, and shipped consumer hardware in a new category in the middle of the supply chain crisis of 2021/2022.

Hardware is hard but turns out it is worthy when done well. The technical risks we’ve overcome now create significant barriers to entry for competition. The hardware enables us to potentially own a platform. Any software company will reach a value asymptote at which point they need a hardware platform- hence why Zuck is spending $10B/yr on VR/AR devices.

Life is great now- all of our challenges are software and customer based. And wow does “inbound interest” feel good. Now that we have shipped product, I finally feel empowered to write this call to action to our future partners on the other side of the table.

Calling back the crazy ones, misfits, the rebels, the troublemakers...

A brief history of VC

Fairchild Semiconductor Cofounders

Venture Capital actually started out with the moniker Adventure Capital, as described in Sebastian Mallaby’s history of Silicon Valley, The Power Law. The goal of this new investment class was high risk/ high reward and in the 1950s this meant: semiconductors.

In 1957, Fairchild Semiconductors became the first startup to receive Adventure Capital funding, because it couldn’t get a bank loan. The traitorous eight actually fell into creating a startup only because they wanted to all find a job that would hire all 8 of them together so they could work together. Fairchild not only pioneered the US semiconductor industry, and enabled subsequent consumer devices (and the birth of SaaS), but 92 public companies can be traced back to Fairchild, with an aggregate market value of over 2 trillion dollars.

So while the trendiness of SaaS is pervasive in VC today, it is only possible because a few brave investors decided to back a few foundational companies. Some of the house hold names that we know and love actually made their mark through high risk/ high reward bets in hardware.

Venrock backed Apple with 300k for 10% of the company, “on a whim”. No one would back the Steve’s because no one could imagine a new platform existing. How could everyone have a computer in their home? Venrock partners went into the hallway after the pitch, and it took one partner shrugging his shoulders and saying “why not?” for the investment to take place

Mayfield backed 3com with 1M for 30% of the company, and generated a 15x return

Kleiner Perkins backed Tandem Computers with 1M for 40% of the company, and took home a 200x return after IPO in 1980.

Sequoia backed Cisco in 1987, founded by an incredibly unlikely couple, Leonard Bosack and Sandy Lerner - one of my new female heroes who was the first woman in her Stanford class, outspoken in character and bucked tradition, even posing naked on a horse for Forbes magazine.

It is worth noting that these bets were made not because of VC’s greater desire to improve humanity, but simply for financial returns. Yet they were essential in propelling society into the modern computing age. How then do we make the transition to the next one?

“The middle path is the enduring one” - Lao Zi

Just as Adventure Capital played a crucial supporting role in building our current protopia, we will need a big shift in the VC industrial complex to nurture and enable this next paradigm change in society. We need to think bigger than just financial returns.

Tragedy of the Commons has become abundantly clear even to the most capitalistic investor. We can’t breathe the air anymore. We’ve contaminated most of the world’s water tables. We can’t find quiet places anymore. Bluefin Tuna are 1/10th the size they were 100 years ago. We’ve lost 90% of the biomass in the oceans since the beginning of last century. 2B people on the planet are lonely. We’re addicted to social media at the expense of real human connection.

We need to be intentional. Mallaby highlights this point in his book as well:

The gap between VC rhetoric and action is is easily mocked. In April 2020, Marc Andreessen wrote an op-ed titled “It’s Time to Build” where he asked “Where are the supersonic aircraft? Where are the millions of delivery drones? Where are the high speed trains, the soaring monorails, the hyperloops, and yes, the flying cars?” The next month A16z invested in Clubhouse, a social networking app.

To have our flying cars and leave the world in a better state than we found it for our offspring, we will need build new and better paradigms. Can that be reconciled with the current incentive structure defined by this current instantiation of capitalism?

I’m not sure. But I hope so.

New worlds that could be

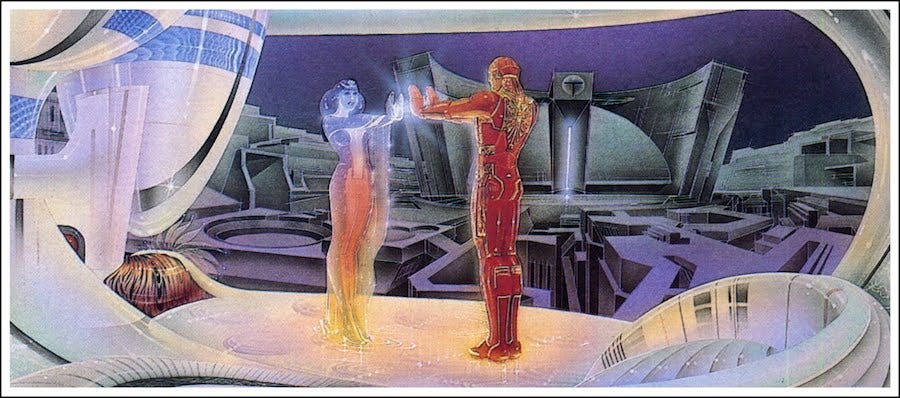

Tron scene by Syd Mead

I’ve always been drawn to the “next step”. I think we have enough brilliant minds solving the bottom sections of Maslow’s hierarchy of needs in fairly straightforward ways - electric cars, plant based meat alternatives, solar and bio fuels, pre-fab housing, etc.

But I’m particularly interested in social tech because it is the path to enable empathy, which is the origin of most if not all of the worlds greatest challenges and suffering, and also the path in achieving self actualization… perhaps even enlightenment.

Interestingly, every new hardware paradigm in the last 100+ years has started out with a powerful social component before expanding to other use cases in which we inevitably lose sight and utility in a monetization frenzy: families used to gather around a living room radio set to listen to nightly broadcasts; families used to sit literally shoulder to shoulder around box TVs because they were incredibly tiny; telephones were used to call loved ones across the country and world; desktop computers were used for messaging platforms like AOL and MSN messenger (as Avram Miller told me this year- “It wasn’t creative tools that drove the adoption of the personal computer, it was social. My employees were staying late at work each day to chat online with other people- I called it home at work instead of work from home”); and mobile phones were used to text, call, and video call people.

I think empathy and emotional data will define the next decade. This is the world I want to live in. This is the world we are building at Emerge. More on this in a future post.